48+ mortgage interest deduction investment property

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. See your rate online now.

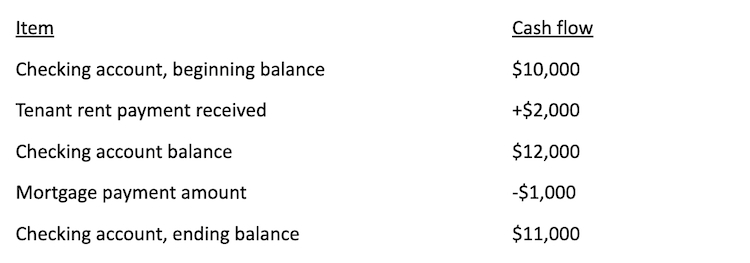

Is Your Mortgage Considered An Expense For Rental Property

Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total.

. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Take Advantage And Lock In A Great Rate. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

51 71 ARM with interest-only cash out options stronger cash flow. Web If your home was purchased before Dec. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad Easier Qualification And Low Rates With Government Backed Security. Homeowners who bought houses before. Use NerdWallet Reviews To Research Lenders.

Not only do investors have the. Ad Start saving for the retirement you envision. Most notably the cap on this deduction was lowered from 1 million.

Explore contribution limits for 2022 taxes. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web If one or more of your mortgages doesnt fit into any of these categories refer to Publication 936 Home Mortgage Interest Deduction to figure the amount of interest.

Web Interest on a mortgage on a residential investment property acquired before 27 March 2021 will be gradually phased out between 1 October 2021 and 31 March 2025. Ad Even lower rates with 51 71 ARM on rental property loans. Web Owning a rental property whether a long-term short-term or vacation rental can be an exciting investment opportunity.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. However higher limitations 1 million 500000 if married. Contribute to an IRA by 418 and potentially lower your income taxes.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The tax bill passed in 2017 changed a few elements of the mortgage interest deduction. Web If the cash-out money was used to improve your primary residence then the interest would be a Schedule A deduction for home mortgage interest but only if you.

Can You Deduct Mortgage Interest On A Second Home Moneytips

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Can You Deduct Mortgage Interest On A Second Home Moneytips

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Deduction Of Mortgage Interest On Rental Property

Is Your Mortgage Considered An Expense For Rental Property

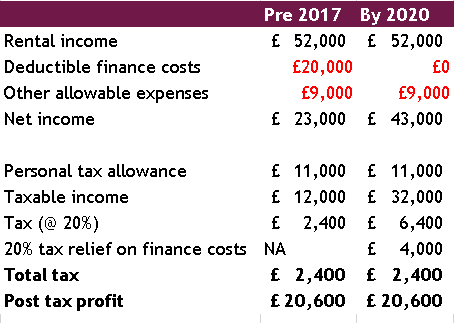

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Faqs Jeremy Kisner

Vacation Home Rentals And The Tcja Journal Of Accountancy

:max_bytes(150000):strip_icc()/cabin-5bfc37f1c9e77c0051831f7e.jpg)

Top Tax Deductions For Second Home Owners

![]()

How Rental Income Is Taxed Property Owner S Guide For 2022

Can You Deduct Mortgage Interest On A Rental Property Youtube

Can You Deduct Mortgage Interest On A Rental Property

Mortgage Broker Berwick Low Rate Home Loan

Landlord Tax Changes Come Into Effect April 2017

Award Winning Mortgage Broker Berwick Low Rate Home Loan